Alibaba one hundred and one: The most significant IPO of all time

A new star in the tech entire world is forming right before our eyes.

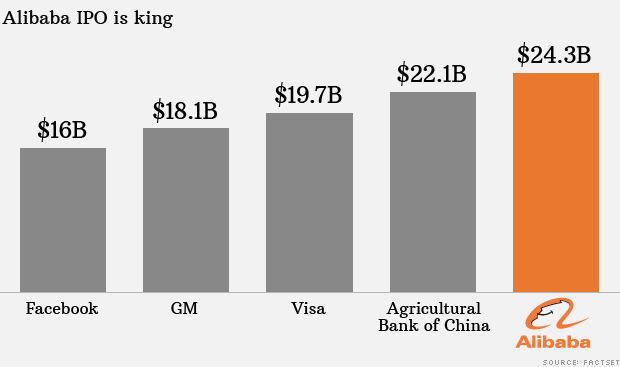

Alibaba, the Chinese e-commerce giant, is poised to elevate a lot more funds in its IPO than Fb or Visa did. It could create an eye-popping $ 24 billion when it begins trading on the New York Stock Trade — probably at the end of following week.

Handful of Individuals have listened to of Alibaba. It truly is usually described as a mix of Amazon.com ( AMZN , Tech30 ) , eBay ( EBAY , Tech30 ) and PayPal for China. It isn’t going to have much of a existence in the U.S., but it’s starting to broaden and now owns stakes in companies which includes Uber, Lyft and look for motor application Quixey.

There are a whole lot of motives Wall Avenue is abuzz about this organization, but here is what you need to have to know:

one. Alibaba will before long be value as considerably as Amazon

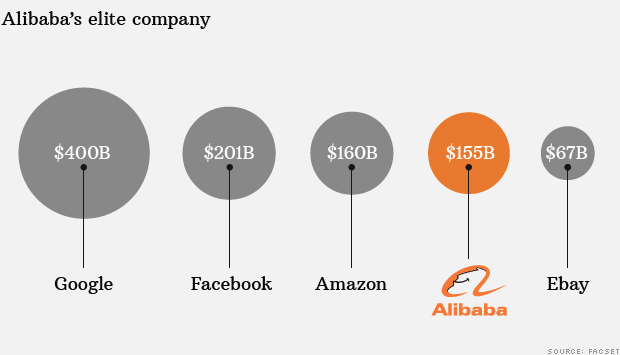

Alibaba established the phase very last week for an IPO that would worth the Chinese firm at a whopping $ a hundred and fifty five billion.

That dwarfs eBay’s $ sixty seven billion market valuation and is roughly in line with Amazon’s $ 160 billion marketplace cap.

Alibaba stock is set to value to begin with between $ sixty and $ sixty six a share. If it goes at the large stop of that assortment, it will activity a valuation that is inside of striking distance of Fb ( FB , Tech30 ) , which went general public in 2012 and is at the moment valued at about $ 201 billion.

There’s nonetheless a long way to go just before Alibaba catches the greatest tech stars. Even if it rates greater than $ 66 a share, it will be well guiding Google’s ( GOOGL , Tech30 ) $ 400 billion and Apple’s ( AAPL , Tech30 ) virtually $ 600 billion market place capitalization.

Still, Alibaba is placing the phase to elevate far more cash than any prior IPO, and that means the firm will have a whole lot of funds on hand to set into research, mergers and purchases of startups around the globe.

two. Alibaba’s IPO could be the largest at any time

Alibaba’s providing would raise up to $ 24.3 billion, if you include money going to buyers and underwriter banking companies. That would effortlessly prime the earlier record-holder between U.S.-detailed IPOs: Visa’s ( V ) $ 19.7 billion elevated in 2008.

That would also break the global report held by the Agricultural Financial institution of China ( ACGBY ) , which hauled in $ 22 billion in a 2010 IPO that was dually listed in Hong Kong and Shanghai, according to Dealogic.

three. Alibaba moves a stunning amount of items

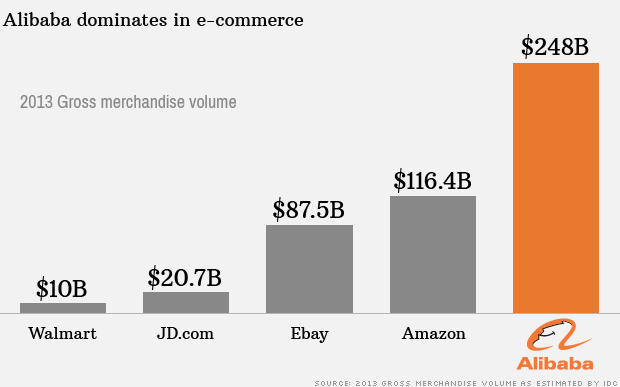

The Chinese organization phone calls by itself the “premier on-line and cellular commerce company in the planet.”

It bases that phone on a widespread e-commerce metric: Gross items quantity. Fundamentally, which is the value of all the merchandise changing palms on a platform above a offered time.

Alibaba generated $ 248 billion of gross products quantity in 2013, towering in excess of Amazon.com’s $ 116 billion, in accordance to estimates by IDC.

In truth, if you include up the price of merchandise being exchanged on Alibaba, it really is higher than that of Amazon, eBay, JD.com ( JD ) and Japanese e-commerce big Rakuten — merged.

Alibaba’s dominance may possibly even increase as China’s middle course proceeds to expand.