Apple has $203 billion in money. Why?

5 beautiful Apple stats

Bad information for Apple. The company is value about $ 40 billion considerably less than it was yesterday.

Good news for Apple. The business has $ 203 billion in money on its balance sheet, turning into the very first corporation ever to cross the $ 200 billion mark.

Apple’s stock sank five% Wednesday morning. The business experienced a solid quarter. But solid is not excellent sufficient when you might be Apple ( AAPL , Tech30 ) . Investors were unhappy that Iphone revenue had been a tiny reduced than expected.

But make no miscalculation. Apple is not in financial problems. It proceeds to mint income. The firm described income movement from functions of $ fifteen billion in its most current quarter.

That helped include to Apple’s document money hoard. The firm had $ 193.five billion at the conclude of April and $ 164.5 billion in cash at this time a 12 months in the past.

Related: Apple’s stock tumbles as Iphone product sales skip forecasts

If Apple keeps piling up funds at this rate, it really is probably to have a quarter of a trillion dollars on its balance sheet at some point in the subsequent year!

CNNMoney tech editor David Goldman and I have joked about all the factors Apple could pay for to acquire with its funds. Each specialist sporting activities staff in the U.S . Disney. Coke. Each Tesla and Uber .

But what is actually actually iStonishing about Apple’s expanding funds pile is the simple fact that it isn’t really exactly stingy with its funds.

Apple main financial officer Luca Maestri pointed out throughout the company’s meeting contact with analysts on Tuesday that the business spent $ four billion for the duration of the quarter on stock buybacks and an additional $ 3.1 billion on dividends.

Which is part of a broader plan to return $ two hundred billion in cash to shareholders by way of buybacks and dividends. That’s one thing which helps hold investor Carl Icahn pleased.

Nonetheless, it’s honest to wonder why Apple needs all this cash. It is one particular issue to save for a rainy working day. But Apple looks to be acting like Noah and planning for a 40-working day flood.

Apple possibly isn’t going to have to fear about an antitrust struggle like the 1 Microsoft confronted with the U.S. government in the late nineteen nineties and early 2000s. No one is calling for Apple to be damaged up.

It also would be a enormous shock if Apple was introducing to its cash reserves in buy to pay for a huge acquisition.

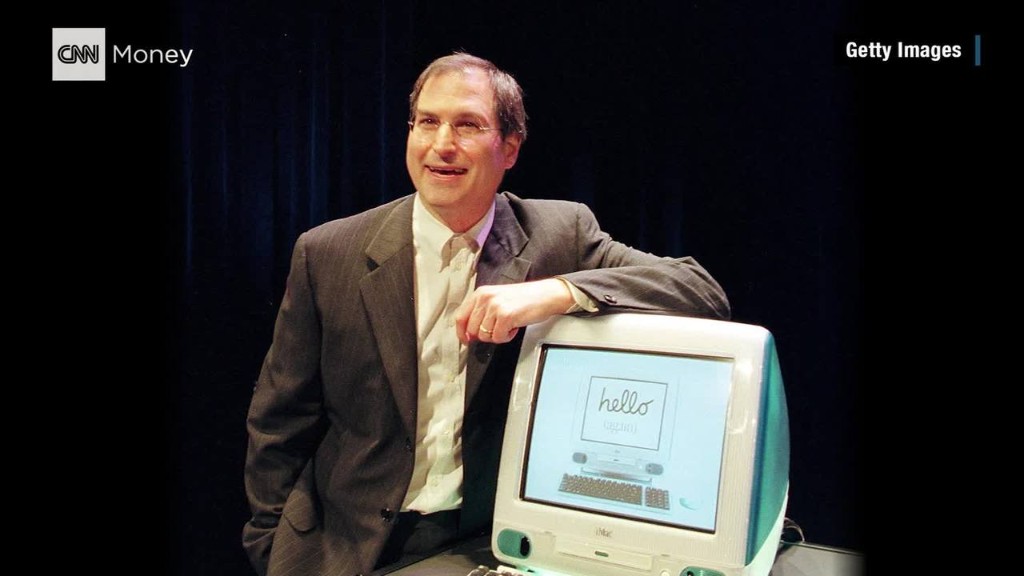

Whilst Apple has been much more apt to do bargains beneath Tim Cook’s view than when Steve Employment was CEO, its largest obtain so considerably was Beats Electronics final 12 months. And that cost a mere $ 3 billion.

Apple may be waiting around for tax adjustments in the United States just before it puts far more of its cash to use although. Maestri mentioned that $ 181 billion of its cash — practically 90% of the total iMountain — is held offshore.

Apple is one particular of several big American tech companies that have been criticized for retaining a lot of their funds in international subsidiaries. Google ( GOOGL , Tech30 ) , Microsoft ( MSFT , Tech30 ) and Cisco ( CSCO , Tech30 ) have also arrive beneath fire for this.

But If Apple moved this funds again to the U.S., it would experience a huge tax bill.

So Apple has truly been heading into hock to assist fund some of its inventory buybacks and dividends. The firm lifted $ 10 billion in credit card debt very last quarter and now has about $ forty seven billion in long-expression financial debt general.

At some position however, Apple could face even far more stress to do something effective with its $ 200 billion war upper body instead of letting it accumulate dust in Ireland and other tax havens.

This couple’s guess on Apple is now well worth $ 1 Million