Believe two times just before dumping your shares because of Greece

five things you might be inquiring about Greece

When huge shocks arrive together like the a single ripping by way of Greece , several investors want to pull their funds from the marketplace. But they normally end up regretting it.

Savvy investors use these market place scares to scoop up a lot more stocks at a low cost.

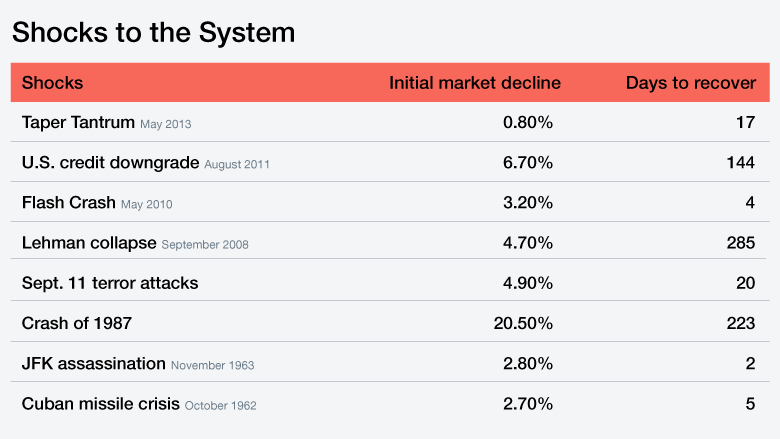

Just search back again at heritage. An S&P Capital IQ investigation of the last 70 several years of marketplace shocks — such as types like the 2010 Flash Crash and Sept. 11 terror attacks — shows that the U.S. inventory market place has a knack for weathering most storms that appear its way.

The median S&P 500 drop the day after a shock to the system was two.four%. That’s fairly close to what occurred on Monday when the industry tumbled in excess of 2% in reaction to Greece’s failure to get to a new bailout deal with its collectors.

In the earlier, it took the stock market a median of just eight times to bottom out after a shock, according to S&P Money IQ.

Quick restoration: In fact, the S&P five hundred recovered all of that misplaced ground in a mere 14 calendar times. Which is quite reassuring to those nervous about how a Greek default or exit of the eurozone could effect their portfolios.

“As historical past has demonstrated, prior industry shocks have usually verified to be better chances to get than bail,” Sam Stovall, main investment decision strategist at S&P Capital IQ, wrote in a notice to consumers.

This investigation by S&P Cash IQ exhibits how the U.S. stock marketplace reacted to different shocks above the past 70 several years.

Is Greece yet another Lehman? Of program, there is no ensure that historical past will repeat by itself this time. The 2008 collapse of Lehman Brothers shows how traders and entire world leaders can underestimate the influence of a solitary celebration. The S&P 500 plummeted 4.seven% soon after Lehman filed for personal bankruptcy. It took the marketplace 285 times to get well from that.

But that epic individual bankruptcy didn’t take place in a vacuum. It transpired in the midst of a bear marketplace in stocks and the scariest economic crisis considering that the Excellent Depression.

Buying on the low cost: Stovall’s evaluation shows that shocks that happen in the course of bull markets — like the 1 we’re at the moment in — generally resolve by themselves swiftly. That enables opportunistic traders a window to scoop up stocks on the low-cost.

That’s more or considerably less what occurred during the final market shock, which took location in Might 2013. Dubbed the “Taper Tantrum,” shares retreated five.8% in excess of 33 days as buyers freaked out above indicators that the Federal Reserve would dial back on its bond-buying stimulus. Following bottoming out, the S&P five hundred received back to even 17 days afterwards.

No worry yet: Although U.S. shares surely responded negatively to the Greek predicament on Monday, buyers did not exactly freak out.

“The market place lost steam as the working day went on, but the market was orderly — there was no stress,” Howard Silverblatt, senior index analyst at S&P Dow Jones Indices, wrote in a report.

Which is simply because Greece doesn’t look to depict the risk to the world-wide economic climate that it did just a handful of a long time back. Most of Greece’s financial debt is now held by other governments an the International Financial Fund, not other financial institutions. That assists include some of the fallout. Circumstances in Spain and Portugal have also enhanced, which helps make a spillover influence considerably less very likely.

That’s minor consolation to people in Greece, but it should appear as a relief to U.S. investors watching the predicament unfold abroad.

“Even though the circumstance is unstable, the difficulties of Greece appear considerably considerably less threatening to the global financial system and marketplaces than they do to the Greek financial system by itself,” David Kelly, main international strategist at JPMorgan, wrote in a notice to clientele.