Goldman Sachs says purchase Ford inventory, dump GM

Now may well be the time to hop into a Ford.

Ford is “hitting its sweet spot,” Goldman wrote in a analysis note Wednesday, specially with its new truck line.

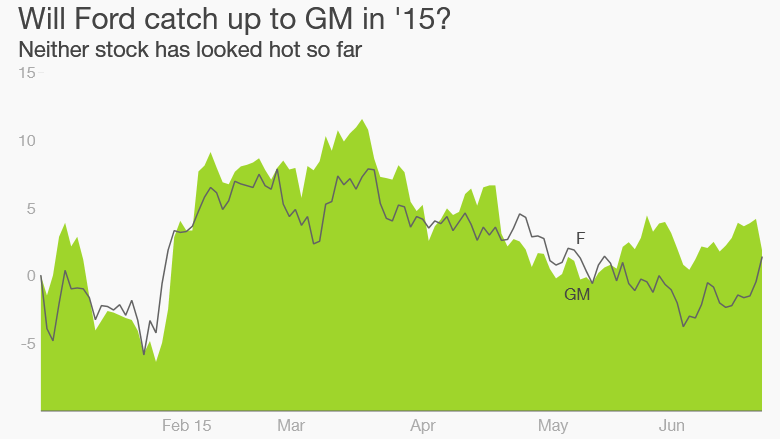

At first, it sounds like an odd suggestion. Ford ( F ) inventory has hardly budged in 2015 in spite of a surge in vehicle income. And Ford shares have trailed rival Standard Motors ( GM ) in the earlier yr.

But Goldman Sachs is betting that’s all about to change. Ford will be the business with outstanding development now, not GM.

That’s why Goldman upgraded Ford to “get” from “neutral” and raised its 12-month price tag target on the car maker’s shares to $ 19. That implies about a 25% upside from Ford’s closing cost of $ 15.29 on Tuesday.

In the meantime, Goldman thinks GM’s “momentum is very likely slowing.” The lender went as significantly as taking GM stock off its advised stocks to buy record.

Vehicles to electricity Ford forward: The massive car get in touch with is dependent on the fact that there are two crucial variations among Ford and GM — and the two favor Ford.

Very first, Ford is one particular year behind GM in its truck refresh. That approach is coming into primetime now, headlined by the new aluminum human body F-Sequence that is priced competitively and probably to entice buyers to change to Ford from other automakers. The new F-150 is poised to start later this calendar year, perhaps thieving sales from GM.

By comparison, GM has currently refreshed its pickups. It’s now focused on updating passenger autos, but that extremely-aggressive area is subject matter to weighty special discounts that eat into earnings.

That is why Goldman believes GM’s North American profitability has probably peaked and is matter to slight declines via 2018. Ford, on the other hand, could take pleasure in a big bump in North American revenue.

GM vulnerable to bumpy ride in China: The other crucial difference is China. Goldman just dimmed its forecast for vehicle sales in China amid the country’s financial slowdown . That is undesirable information for each automobile makers, but specially GM. It owns fourteen% of the marketplace share there, as opposed to just four.five% for Ford.

“Ford is less susceptible to a softening China,” Goldman wrote.

Ford also has more area to grow in that essential marketplace. It really is launching an intense press there by introducing fifteen models this calendar year by yourself.

Wall Avenue didn’t hold out prolonged to heed Goldman’s guidance. Shares of GM dipped virtually 2% on Wednesday, even though Ford revved that much higher.