How we manufactured almost $one million on Apple stock

Satisfied Apple buyers: Ning Wang and Ting Qian.

Ning Wang and his wife Ting Qian purchased Apple shares in the late nineteen nineties and refused to promote them, even in the course of the dotcom bust and the Wonderful Economic downturn. That religion in Apple has produced them almost $ one million.

“We didn’t worry. We know the inventory market goes up and down,” said Wang, who very first bought one hundred shares of Apple ( AAPL , Tech30 ) with his wife in August 1998.

The pair didn’t budge even when Steve Work — the coronary heart and soul of Apple — died in Oct 2011. That was a wise move. Apple shares have practically doubled because then. Nowadays it’s the most worthwhile business on the earth.

“We imagine a good brand and a great company can final very lengthy right after the founder passes absent. So we stayed with Apple,” stated Wang, who is fifty nine several years previous.

He shuns the nuts-and-bolts analysis you locate at big investment banking companies.

“At the commencing we recognized Apple items are practically like jewels. Men and women are happy of their Apple solution. That’s not a technical Wall Road analysis,” he said.

The Queens, N.Y. few arrived from China as overseas learners in the eighties, earning their Master’s levels and locating perform. They also co-printed Advertising and marketing in The usa , a Chinese-language ebook.

Wang is presently editor-in-main of Sing Tao Newspapers, a big Chinese newspaper chain, although Qian is a communications manager at the Institute of Electrical and Electronics Engineers Communications Modern society.

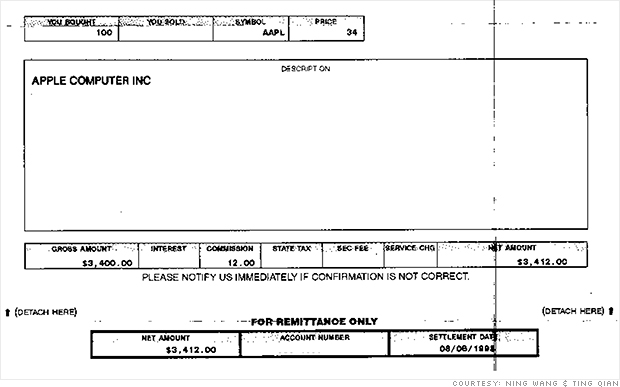

Outstanding return on expense: The couple determined to obtain a hundred shares of Apple (then called Apple Computer Inc.) at $ 34 a piece in 1998, in accordance to trade confirmations provided to CNNMoney.

Getting into account Apple’s inventory splits (there was a 2-for-one break up in 2000 and yet again in 2005, as effectively as the seven-for-1 break up this past June ), their first order of a hundred shares translates to 2,800 shares right now.

Trade affirmation:

The first trade confirmation from 1998.

Presented the current Apple cost of all around $ 100, those shares are now worth about $ 280,000. Subtracting their initial $ three,400 investment leaves a enormous earnings of $ 276,600 — from that very first trade by yourself.

That is a phenomenal return on their investment decision.

Wang and Qian also shared with CNNMoney trade confirmations demonstrating they invested in 500 a lot more shares in 1999.

All advised, the few calculates they’ve created $ 650,000 in unrealized income furthermore an additional $ a hundred and fifteen,000 in understood earnings from some sales.

Lured by Apple products: For Qian, acquiring shares in a business is like creating a prolonged-phrase romantic relationship. She and her husband were drawn to Apple by a really like for the firm’s goods.

“[Apple’s] financial outlook, figures and knowledge are essential, but not the main explanation to trigger purchasing the stock,” she mentioned.

Qian, 51, describes herself as a “pleased stop consumer of Apple merchandise,” owning every thing from the Mac and iPod to the Iphone. She after attended a keynote speech by Jobs and closely followed merchandise launches.

She said she could almost “come to feel the soreness” from Apple’s freefall throughout the economic disaster.

Like many buyers, the pair made some tweaks over the years. They did market some shares early final ten years only to purchase them back at an even reduced value. One particular exception occurred close to 2006 when they experienced to acquire them back again at a increased value. Since then they have not often taken any chips off the desk.

“We recognized it was a error timing the industry on this increasing inventory,” explained Wang.

The Iphone developed

Connected: Tim Cook dinner is not Steve Employment. So what?

What is actually following? The couple’s deal searching isn’t constrained to just the inventory market place. In recent many years they have obtained and renovated 5 residences in the Poconos. 4 properties have been in foreclosure and one was acquired via a limited sale.

They’ve also diligently contributed to their 401(k) and IRA accounts, which now have about $ 1.five million in them.

Qian and Wang adore their positions and have no plans to retire. But thanks to their savvy true-estate and inventory investments, they undoubtedly could if they desired to.