Shares: 5 items to know prior to the open up

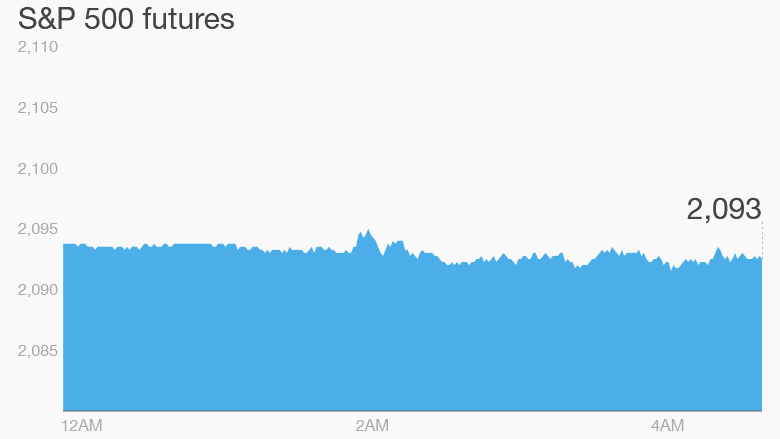

Click on the chart above for far more premarket information.

Markets are seeking serene Tuesday even though a landmark offer on Iran’s nuclear plan is hitting oil costs.

European marketplaces slipped and U.S. stock futures have been edging reduce.

Below are the 5 factors you want to know ahead of the opening bell rings in New York:

one. Iran deal: Iran and the West have ended prolonged-operating negotiations with a offer that will carry sanctions in exchange for curbs on Tehran’s nuclear program.

Sanctions have hobbled Iran’s economic climate and restricted oil generation and exports, and the place is eager to get back its status as a worldwide energy electricity.

Crude rates slumped one.eight% to just earlier mentioned $ 51 a barrel in electronic investing as investors reacted to the deal, which could see a flood of new oil materials from Iran.

two. Greek bailout: Prime Minister Alexis Tsipras will encounter disgruntled colleagues and the Greek community as he seeks approval for a new bailout. The deal includes hard new austerity actions and Greek lawmakers will vote on the 1st bundle of reforms, which include pension cuts and tax raises, on Wednesday.

The bailout could inject up to $ 96 billion into the distressed economic system, but it really is not a done offer nevertheless.

“Acquiring the deal however parliaments elsewhere in Europe is not going to be all that easy, but it is in Greece that the fallout could be witnessed most plainly in the sort of new elections,” Societe Generale strategist Kit Juckes stated.

three. Earnings and economics: It really is a active day for earnings updates. Wells Fargo ( CBEAX ) , Johnson & Johnson ( JNJ ) and JP Morgan Chase ( JPM ) all report in advance of the open up. Yum! Brands ( YUM ) — which owns Taco Bell, Pizza Hut and KFC — will report right after the near. Its inventory is up twenty five% this 12 months, but analysts forecast a twelve% fall in the cafe company’s earnings.

4. Market movers: Chinese point out-owned agency Tsinghua Unigroup is planning a $ 23 billion bid for U.S. chipmaker Micron, the Wall Avenue Journal noted on Tuesday. Micron ( MU ) shares have been up ten% in premarket trading.

5. Intercontinental markets: European marketplaces have been shedding a small ground in early trading, with Germany’s DAX down .3% and France’s CAC dipping .2%.

Asian markets ended with blended final results. Japan’s benchmark Nikkei index closed up one.five% although the Shanghai Composite snapped a three-working day winning streak to close down 1.2%. Chinese stocks have been on a wild journey for weeks forcing the govt to take a collection of steps to temper volatility.

U.S. markets turned in a powerful performance Monday. The Dow Jones industrial typical climbed one.2%, whilst the S&P 500 included one.1% and the Nasdaq place on one.5%.