Shares: four issues to know just before the open up

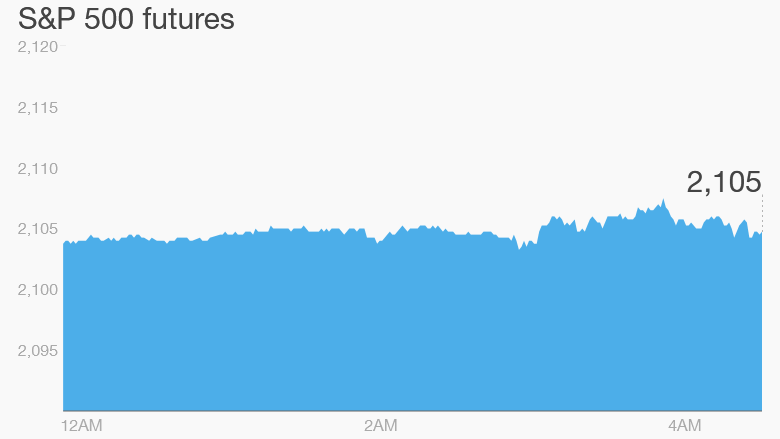

Click on chart for in-depth premarket knowledge.

Wall Street observed impressive gains Wednesday, but now it looks like traders require to catch their breath.

U.S. inventory futures are not creating any major moves Thursday.

Below are the four factors you need to have to know prior to the opening bell rings in New York:

one. Fee reduce in South Korea: South Korea’s central bank has unexpectedly lower fascination rates dependent on issues that a modern outbreak of Center Eastern Respiratory Syndrome (MERS) will hit progress, investing and economic sentiment.

So much, ten folks have died following contracting MERS. There are more than one hundred twenty verified instances.

More than two,400 schools have been closed, and 1000’s of people have canceled trips to the nation. Restaurants, transportation companies, local exhibitions and beauty firms have taken a hit.

two. Earnings and economics: Leapfrog ( LF ) and Restoration Components ( RH ) are reporting following the close.

On the economic aspect, the U.S. Census Bureau will release its retail revenue report for the month of May at 8:thirty a.m. ET. Economists will be seeking for an uptick in revenue following flat numbers in April.

Also at eight:30 a.m., the Department of Labor will release the newest weekly jobless claims information.

3. Intercontinental marketplaces overview: European markets are continuing to rise in early buying and selling, sustaining the optimistic momentum from Wednesday.

Worldwide federal government bond prices proceed to tumble, pushing yields up. The U.S. government’s ten-year bonds are presently yielding two.forty nine%, up sharply from previously in the calendar year when they ended up yielding 1.65%.

Most Asian marketplaces finished with gains, apart from for the Mumbai Sensex , which is declining by above one%.

The U.S. greenback is strengthening from most main currencies.

4. Wednesday industry recap: U.S. shares were served greater Wednesday by rumors of a offer to resolve Greece’s debt crisis.

The Dow Jones industrial typical and Nasdaq both jumped by 1.3%, even though the S&P 500 gained 1.two%.

As it stands, the Dow would require to increase by another 1.five% to match its all-time closing higher. The S&P 500 would want a additional 1% thrust and the Nasdaq would need to increase by yet another .five%.