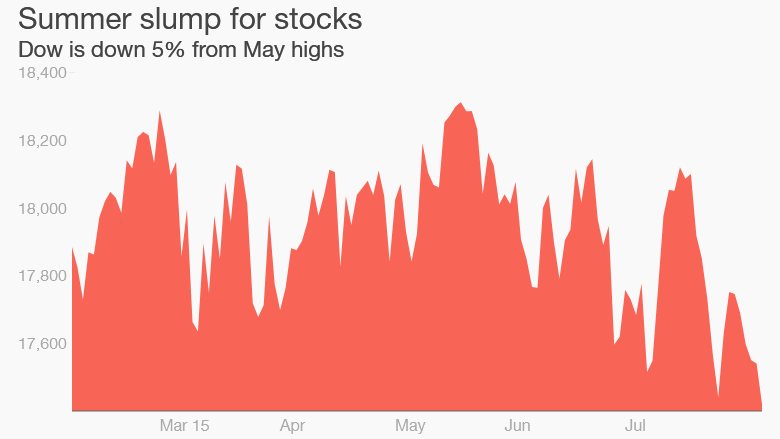

Summertime slump: Dow drops to lowest position since February

Brace yourself for a bumpy August

Wall Road is in a summer slump.

The Dow has dropped for six times straight, its longest losing streak considering that Halloween. The index is now down more than two% for the year — and which is not what investors want to see.

Stocks fell once again Thursday, taking the Dow to its lowest stage considering that early February.

So what is actually heading on? Blame the slump on jitters ahead of the critical month to month employment reported out Friday early morning or nervousness about the Federal Reserve’s “liftoff” strategies to raise interest rates for the initial time in about a 10 years. But the more instant considerations are earnings. You will find a meltdown going in media stocks . And espresso shares . And at minimum one electric automobile maker .

There’s also a wave of selling in crude oil, copper and other commodities that emerging markets like Brazil, Chile and Mexico count on. It really is gotten so negative that Saudi Arabia is truly borrowing cash now to close its budget deficit.

“There are considerations it will broaden to an rising marketplace contagion situation. It’s got the market place spooked a tiny little bit,” explained Michael Arone, chief expenditure strategist at Condition Avenue World-wide Advisors.

It truly is not just the Dow getting a strike. The S&P 500 declined nearly 1% on Thursday and the Nasdaq slid 1.six%, even though people two indexes are at the very least still in positive territory on the year.

Espresso, Tesla & Fitbit tears: Traders are freaking out about awful “report cards” from major organizations, or at the very least types that unsuccessful to dwell up to the hoopla.

Just appear at Keurig Environmentally friendly Mountain ( GMCR ) , simply the greatest loser in the S&P five hundred. The immediate coffee maker plummeted 30% — its worst working day in 3 years — right after expressing product sales of its brewers plummeted 26% previous quarter. Keurig’s battling so a lot that it is laying off about 330 personnel. Rival TreeHouse Food items ( THS ) unveiled benefits that advise it’s obtaining troubles as well.

So the K-Cup coffee trend may well be above . Not the end of the globe. But lots of other individual shares are having a hit thanks to disappointing earnings.

Tesla ( TSLA ) shares tumbled nine% after dialing back its estimate on how several electric powered cars it programs to produce this yr. Elon Musk’s firm also misplaced a whole lot far more funds than buyers were bracing for.

Fitbit ( Suit ) income virtually quadrupled final quarter and it posted a larger revenue than forecasted. However the wearable fitness firm’s inventory is tanking as well.

Media meltdown: And then there’s the nightmarish week for media shares. Walt Disney ( DIS ) plummeted nearly 9% on Wednesday thanks to deep considerations about ESPN . Disney verified ESPN — its big moneymaker — is encountering “some subscriber losses.” That is raising fears about so-known as “wire reducing” by Netflix ( NFLX , Tech30 ) homes who are deciding on smaller bundles of cable.

Individuals jitters are infecting rivals . Despite reporting in-line outcomes, MTV owner Viacom ( VIAB ) plunged fourteen% on Thursday. Rupert Murdoch’s twenty first Century Fox ( FOXA ) and CNNMoney proprietor Time Warner ( TWX ) experienced equivalent fates even with earnings beats. Disney also slid further.

Employment, Fed loom: For a selection of causes, August is off to a tough begin. August will get a bad rap with traders for currently being a challenging time for shares. But historical past provides some purpose for hope . Whilst the month is typically a risky one for stocks, U.S. markets have posted gains in ten of the very last fifteen Augusts.

No matter whether this August breaks from that pattern could be determined on Friday. Which is when the monthly employment report is scheduled to be introduced. CNNMoney’s study of economists predicts 216,000 employment had been extra in July, which would be much less than the 223,000 jobs additional in June.

Generally a big offer, this positions report’s value is elevated by the reality it will be the previous significant piece of economic knowledge introduced ahead of the Federal Reserve huddles next thirty day period. If it feels the financial system is healthful sufficient, the Fed may decide to increase fascination costs for the initial time in nearly a decade.

CNNMoney’s Brian Stelter, Patrick Gillespie, Paul LaMonica and Jackie Wattles contributed to this report.