Did you sell in Could and go absent? Oops!

Higher anticipations on Wall Road

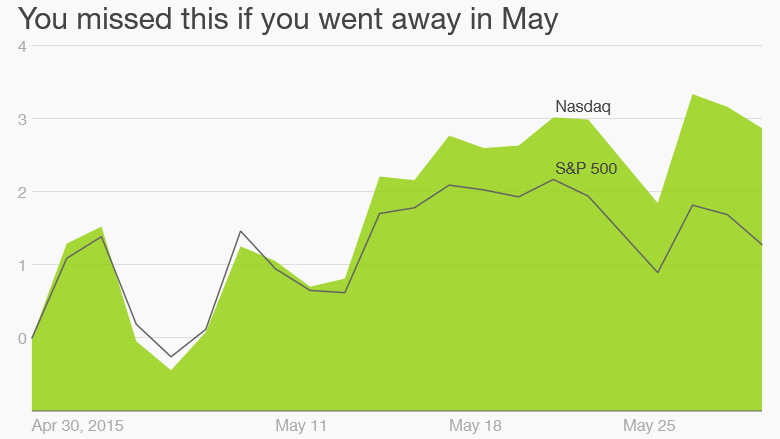

Sell in May and go away. You hear traders say that about the inventory industry every year.

But if you truly adopted that foolish piece of guidance, you missed out on much more gains.

Even even though shares slid Friday, the Dow and S&P five hundred concluded the month up 1% whilst the Nasdaq rose nearly three%.

It was not a easy experience up. There have been matches and commences. But these three significant market indexes are all close to their document highs.

Will the marketplace continue to climb for the relaxation of the summer? Forget about the calendar and the meant summer slump. The market place has rallied from May possibly through September for the earlier three many years.

It truly is the economy … Whether or not that trend carries on will depend on two items: how the U.S. economic climate is doing and how the industry thinks the Federal Reserve will react to the knowledge.

It really is no key that the 1st quarter was a difficult 1 for The united states. We just discovered out on Friday that the financial system really shrank a bit. But that is primarily because of to the temperature. The identical factor transpired previous calendar year.

The financial quantities we’ve seen for the second quarter so significantly have pointed to some modest enhancement.

Hiring picked up in April . The housing market place restoration continues to be on keep track of. Business are paying — even if buyers usually are not.

But it truly is even now not clear what this indicates for the Fed — which has mentioned that it plans to ultimately increase desire charges. The question is when? That’s all that Wall Road looks to care about these times.

Rates have been held in close proximity to zero given that December 2008. So there is appreciable nervousness about what will occur to shares and bonds when the Fed last but not least hikes costs.

Interest charge jitters. Earlier this year, several imagined the Fed would elevate charges in June. No one believes that will happen now. The current typical knowledge is that that a charge hike may happen in September.

But if the financial system continues to be sluggish, it truly is attainable the Fed could delay an interest rate shift to later in the year … or possibly drive it back again to 2016.

So we might be again in a manner where very good financial information is regarded poor since it could push the Fed to act sooner instead than later on.

Shares took a terrible tumble Tuesday following first rate financial studies sparked much more rate hike fears.

That pushed up the worth of the dollar — which ought to increase when the Fed raises charges.

Investors have not been supporters of the stronger buck since it hurts the profits of huge multinational organizations like Procter & Gamble ( PG ) , Johnson & Johnson ( JNJ ) , Coca-Cola ( KO ) and Walmart ( WMT ) . And the only E word that issues to Wall Road more than economic system is earnings.

Just do it, Fed! Of course, there are other variables that traders will be observing this summer.

The latest developments in Greece and the relaxation of Europe. The course of China’s economic climate. The most recent actions in oil charges.

But it all comes again to the Fed. The greatest factor for the market place might be to ultimately get the charge hike out of the way.

Like numerous items that folks dread — heading to the dentist, doing your taxes and returning that phone contact from your mom come to brain — the true celebration typically turns out to be a great deal significantly less spectacular than you feared.

And at the conclude of the working day, a rate hike is a good indicator. It would demonstrate once and for all that the Fed feels the economic disaster and Excellent Economic downturn are Lastly driving us and that the restoration is for actual.