Dow falls 313 details as biotech will get crushed

CEO backs down following drug cost hike

The skittish stock market place took another tumble — and plunging biotech stocks led the way lower.

The Dow slid 313 details and the S&P five hundred lost 2.six% on Monday. The Nasdaq seasoned steeper losses, shedding 3%. It was the Nasdaq’s worst 1-day drop considering that August 24, the day the Dow took an unprecedented one,000-point nosedive.

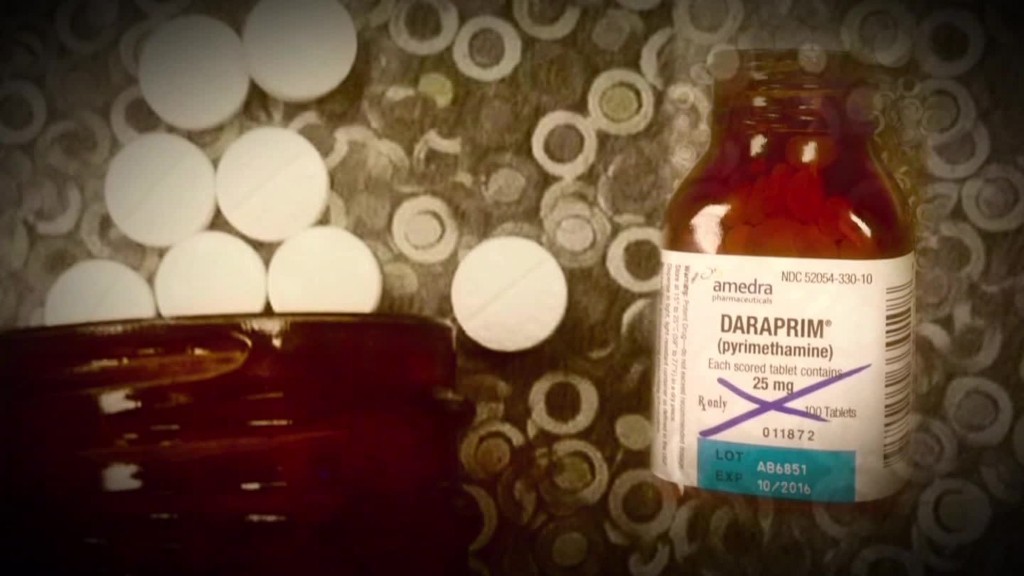

The biotech sector carries on to get crushed. Prolonged a preferred of traders, biotech shares have stumbled amid considerations that political force will finish steep drug price raises.

The iShares Nasdaq Biotechnology ETF ( IBB ) plummeted 6.three% on Monday, its most significant a single-working day loss given that 2011. The ETF has soared nearly 600% since March of 2009. But in just the last 6 trading times, it is fallen practically 19% given that Hillary Clinton tweeted her outrage about alleged “price tag gouging” by drug makers.

“Buyers are in a much more conservative temper proper now. The increased the valuation of a sector, the much more vulnerable it is,” explained David Kelly, chief worldwide strategist at JPMorgan Resources.

Valeant Prescribed drugs ( VRX ) plummeted almost seventeen% after Congressional Democrats pushed to subpoena the organization above current value hikes on two coronary heart drugs.

But it’s not just biotech in retreat manner. All 10 sectors and 490 shares in the S&P five hundred dropped ground on Monday.

Fed stress mounts

Deep uncertainty about the future has held investors on edge. Numerous have no idea when the Federal Reserve will increase fascination prices, a seminal function for the markets.

Right after the Fed decided before this thirty day period not to raise prices, the stock market place reacted negatively. The Fed’s statements fanned fears the worldwide outlook was darker than beforehand imagined.

Now the Fed is sending the marketplaces combined indicators on when a rate hike will occur.

Fed chief Janet Yellen and New York Fed President Monthly bill Dudley reiterated given that then that a fee hike is coming this 12 months. Nonetheless, Chicago Fed President Charles Evans, a voting member of the Fed, recommended the central bank ought to hold off right up until the middle of following yr.

“While transparency is very good, what the industry genuinely wanted is clarity. What we are seeing as an alternative is confusion,” explained Kate Warne, expenditure strategist at Edward Jones.

Global growth jitters persist

The investing outlook is also getting muddied by a slowdown in worldwide economic development, led by China.

China’s problems have hurt charges for uncooked materials like crude oil, copper and iron ore. It is a terrible time for nations and businesses that rely on commodities for income.

Glencore ( GLCNF ) is a key case in point — shares of the mining big plummeted virtually 30% on Monday as traders feared how it would support its massive personal debt load. One analyst even warned Glencore’s shares could become practically worthless.

Glencore’s difficulties are “reverberating during the relaxation of the markets these days,” stated Aknur Patel, main expense officer at R-Squared Macro Management.

The power sector was the worst performer on Monday, shedding yet another 5%. Businesses like Chesapeake Strength ( CHK ) and Selection Sources ( RRC ) misplaced 9% apiece.

Time to deal hunt?

Although it is a terrifying time for individuals with cash in the marketplace, other individuals who have been ready on the sideline could be lured in by more affordable costs.

Considerations that shares have gotten as well expensive need to be eased by the current pullback, assuming corporate profits will not fall off a cliff.

“Individual buyers should pay no attention to this at all. If the economic climate is good then this does represent a getting opportunity. It really is a hard day to say that but it’s the truth,” stated JPMorgan’s Kelly.