Greece’s hideous option: A lot more austerity or collapse

Greek finance minister will not likely ‘extend and pretend’

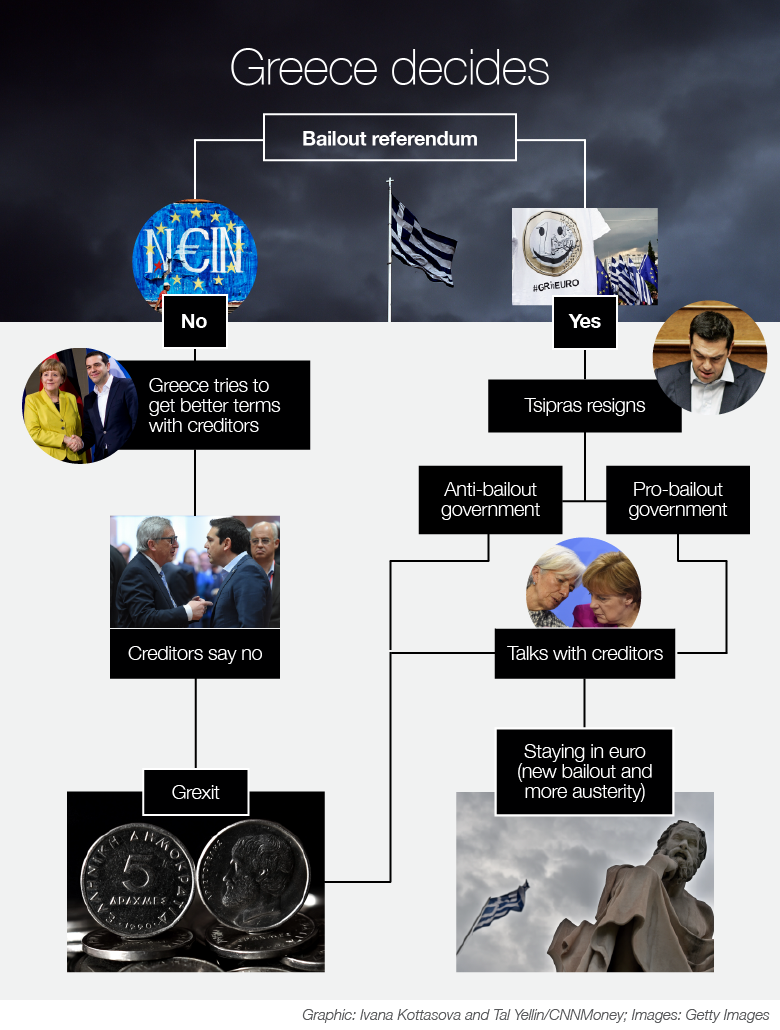

Greece is dealing with a hideous choice: A 3rd enormous intercontinental bailout with rigorous austerity hooked up, or economic collapse.

Greeks are making ready to vote Sunday in a referendum on whether or not to accept a bailout provide from Europe and the Worldwide Monetary Fund. Prime Minister Alexis Tsipras is urging people to reject the proposal , declaring that would bolster his hand in negotiations.

But there is certainly a large problem: European leaders say a “no” vote would demonstrate Greece is unable to carry out the reforms needed to maintain the euro. A return to the drachma would seem unavoidable.

“I feel there would not only be no foundation for a new [bailout] but it would be very much the query no matter whether there would be a foundation for Greece in the eurozone,” explained Jeroen Dijsselbloem, president of the Eurogroup of finance ministers.

Here is how the vote could enjoy out:

What a “no” vote implies

If Greece votes “no” it would practically definitely guide to its exit from the eurozone, the so-called “Grexit” state of affairs.

Which is due to the fact Greece has virtually run out of money, and only Europe can preserve it.

“If there is a ‘no’ vote, it would be very difficult to commence new bailout negotiations,” said Vassilis Monastiriotis, professor of political economic climate at the London College of Economics. “Politically, there would be no way to support it.”

The newest: Greece in Disaster

If Greece can’t get far more bailout money from Europe quickly, it will have to pay out pensioners and public sector employees with IOUs — possibly inside months. Its banks would have to keep shut or get new funding from someplace.

Which is when Greece would be compelled to begin printing its personal forex. The new drachma would be worth considerably less than the euro, making essential imports significantly a lot more high-priced for ordinary Greeks .

Items would get even worse really swiftly for most Greeks, who are previously experience the pain of six years of recession. The economic climate could shrink by yet another 25% in just two several years. Political and social unrest may possibly comply with.

Europe is previously speaking about providing humanitarian assist, this kind of as healthcare materials, exhibiting just how desperate issues could get.

What a “of course” vote means

A “of course” vote could supply a way out of the disaster but it won’t be simple or rapid. Here’s why:

The bailout provide the Greek federal government has set to its people expired on Tuesday. That implies a completely new settlement has to be negotiated.

Tsipras has hinted he will resign if there is a “of course” vote. Greece would want a new leader at the very least, and perhaps even a new govt.

Greece would have to take even more durable shelling out cuts and tax rises than those on the table a couple of times in the past since of the financial damage inflicted by this week’s financial meltdown.

A new bailout will consider months to negotiate. Greek financial institutions could reopen sooner if the European Central Financial institution begins pumping in emergency funding again. For that to happen, the ECB will need to believe that a deal can be completed.

The Greek crisis…in two minutes