Hundreds of Lender of The united states branches are disappearing

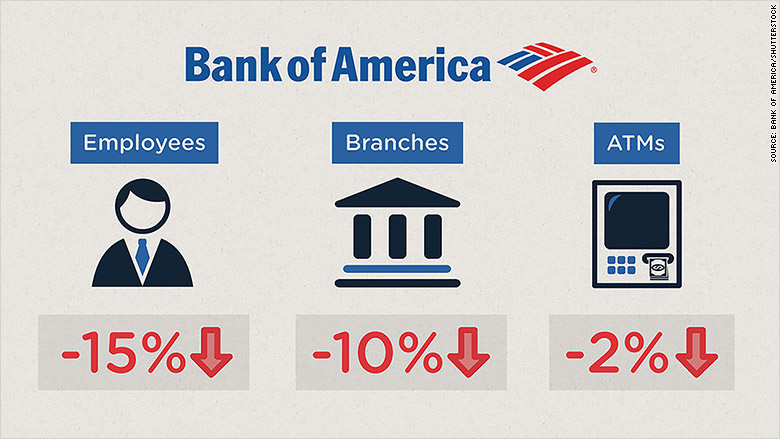

Financial institution of America’s workforce and branch community has declined by double-digit percentages above the previous two years.

If your Lender of The usa department disappeared, you are not by yourself.

The nation’s next-premier lender has pulled the plug on hundreds of branches and removed tens of thousands of work over the previous two years. Lender of The usa ( BAC ) is not the only huge bank scaling back, but it really is been between the most aggressive to do so in the United States.

The retreat is part of BofA CEO Brian Moynihan’s endeavours to slash fees and capitalize on the shift to cellular banking. It is also the bank’s way to aid make up for its gigantic legal costs as it continues to fights a litany of lawsuits relevant to shoddy mortgages prior to the economic crisis.

In an period of extremely minimal curiosity rates, group banking is also not that hot.

“Again in the day, it manufactured perception to open up bank branches all above the place. You couldn’t stroll down a road in New York without seeing two or three branches,” explained Dick Bove, a banking analyst at Rafferty Money.

Banks then were giving free of charge checking accounts and other incentives to lure People in america into branches and deposit their income.

But that was when fascination rates were not in the basement. Today, both brief and long-time period prices are very low. That flat generate curve can make it a lot much more difficult for banks to change a income on the difference among the desire they pay out out on deposits and the volume attained on loans.

“Now they do not want the deposits — and they do not want the branches. They are acquiring rid of them,” Bove stated.

BofA’s shrinking footprint: Two a long time in the past there had been five,328 U.S. branches at Bank of America. That has steadily declined each quarter since then, shrinking to four,789 as of the conclude of the next quarter, a ten% fall.

Fewer branches means BofA also needs less workers. The bank’s workforce has declined by virtually 16% in excess of the past two many years to 257,158 today.

BofA-branded ATM machines are also becoming slowly sliced out. They have dipped by two% over the very last two a long time to virtually 16,000.

Customers jump to cellular: BofA has been able to downsize its actual physical existence by ramping up cell. The loan provider now has far more than 17.6 million consumers actively using its cell system, where users can deposit checks and send income to other folks. Customers deposit two hundred,000 checks each working day by mobile and also book about ten,000 appointments to satisfy with branch personnel each week.

The financial institution proceeds to “experience a shift in customer conduct designs absent from branches and in direction of a lot more self-provider,” BofA CFO Bruce Thompson advised analysts for the duration of a meeting call on Wednesday.

Of training course, there is a risk that BofA and other banking companies could alienate less-tech savvy consumers, including elderly ones who are cozy heading to a lender branch.

“Getting the branch away from them does piss them off. I do believe there is a reduction of customers… the Little one Boomers do not like it,” said Bove.

Other banking companies are scaling back again, too: BofA is barely the only financial institution closing branches. JPMorgan Chase ( JPM ) stated this week its branch count has declined by 2% in excess of the previous 12 months to 5,504. Its headcount has tumbled by six,000, assisting conserve the bank much more than $ 500 million in the course of the first fifty percent of the year.

Citigroup ( C ) is retreating globally, announcing programs to depart far more than a dozen nations around the world. Before this 7 days it agreed to market its retail banking businesses in Panama and Costa Rica, signing up for other jettisoned marketplaces like Japan and the Czech Republic.

Wells Fargo ( WFC ) is the lone exception. The bank informed CNNMoney its department rely has “held consistent” above the final numerous a long time at practically six,200 in the U.S. Wells Fargo’s workforce really improved by one,000 to 266,000 as of the stop of the second quarter, even though ATMs rose by 300 to twelve,800.

Wall Avenue enjoys it: Bove explained BofA has been more intense than its rivals in shutting branches domestically. Never assume that to modify.

Financial institution of The united states shares are rallying three% on Wednesday, and are up almost thirteen% more than the past calendar year.

“Moynihan is performing what he promised. Naturally, traders enjoy it,” Bove stated.