This stock is up far more than one,000% in the previous 3 times

Traders are in love with dangerous biotechs. But they need to be cautious or they will get burned. Just look at Aquinox.

You’ve most likely never listened to of Aquinox Pharmaceuticals, a tiny biotech based in Vancouver.

But the inventory is the new preferred plaything of working day traders. They have been batting it all around again and forth like a bunch of kittens with a ball of yarn.

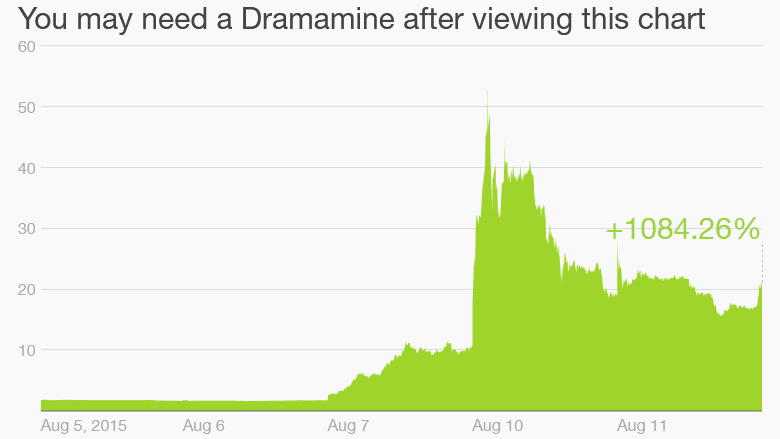

Shares had been investing for significantly less than $ two on Friday. They closed on Tuesday at about $ 21 — a staggering achieve of almost one,one hundred%.

Aquinox actually went as large as $ fifty five.75 at one point Monday. At that point, the achieve considering that Friday was thirty,000%!

But on Tuesday, the shares fell as a lot as eighteen% at one particular stage ahead of staging a massive comeback in the very last half hour of buying and selling to end the working day up eleven%.

What the heck is heading on? Aquinox ( AQXP ) was not immediately available for comment.

The inventory very first exploded Friday after Aquinox announced favorable take a look at outcomes right after the closing bell Thursday for its AQX-1125 drug, designed to take care of bladder soreness.

Aquinox soared once again Monday following a single of its top shareholders, biotech-centered hedge fund Baker Bros. Advisors, disclosed in an SEC filing that it acquired 3 million a lot more shares of the organization.

Baker Bros. turned the most significant shareholder in the firm with that obtain. It now owns a nearly 40% stake.

Buyers may possibly also be thrilled by the reality that Aquinox also has the backing of two giant drug companies. Johnson & Johnson ( JNJ ) and Pfizer ( PFE ) each very own far more than ten% of the organization in accordance to their most recent SEC filings.

So there is an air of legitimacy with the business.

J&J and Pfizer had been not quickly available for remark about why they invested in the business in the initial place and whether or not they have marketed any inventory adhering to its latest surge.

But is it healthy for any stock to go up this significantly in just a few times? There are a couple of important lessons listed here for average traders.

Very first, investing in little biotechs is incredibly dangerous. Except if you really recognize the science, you might be flying blind. These stocks are likely to shift more on headlines about scientific trials, not earnings studies.

Second, do not chase the buzz when it is this severe.

Anyone who bought Friday is even now sitting down on a income. But individuals poor people who acquired suckered into acquiring it around $ fifty six Monday? Or even at $ 35 on Tuesday?

Last but not least, traders ought to possibly keep away from shares of firms that are this modest. Aquinox is well worth just $ one hundred seventy five million … and that is right after its phenomenal runup. Prior to Friday, its marketplace cap was just $ eighteen million.

There are only 4.five million shares offered for general public investors. And people shares have been modifying palms at a feverish speed.

The investing volume on Friday was sixty two million shares. It wasn’t as frantic Monday, but quantity was still abnormally high at eighteen million shares.

Aquniox has been trending on investing social media website StockTwits for the past couple of days.

A single trader summed up the stock’s crazy moves the best: “Several were warned, ought to have went to Vegas rather,” wrote a person named smallpotatoe .